HOTSPOT -

A company uses Dynamics 365 Finance to manage fixed assets. The company's fiscal year is set as the calendar year.

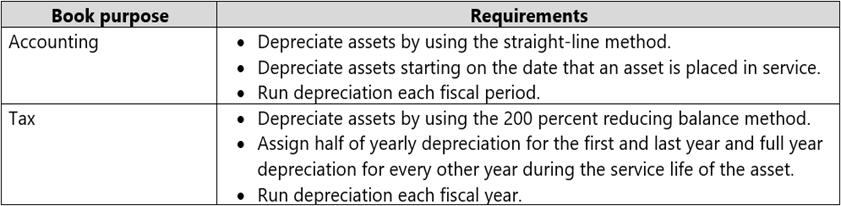

The company requires two books for each fixed asset. The company has the following requirements for the books:

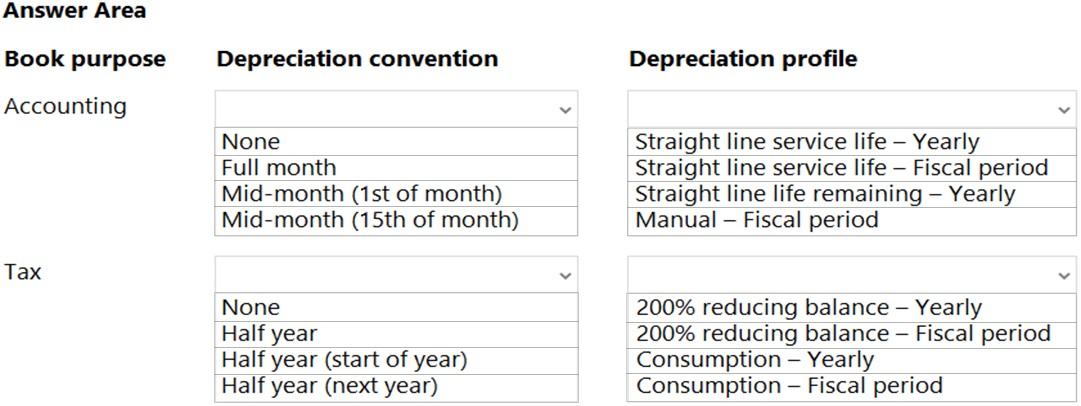

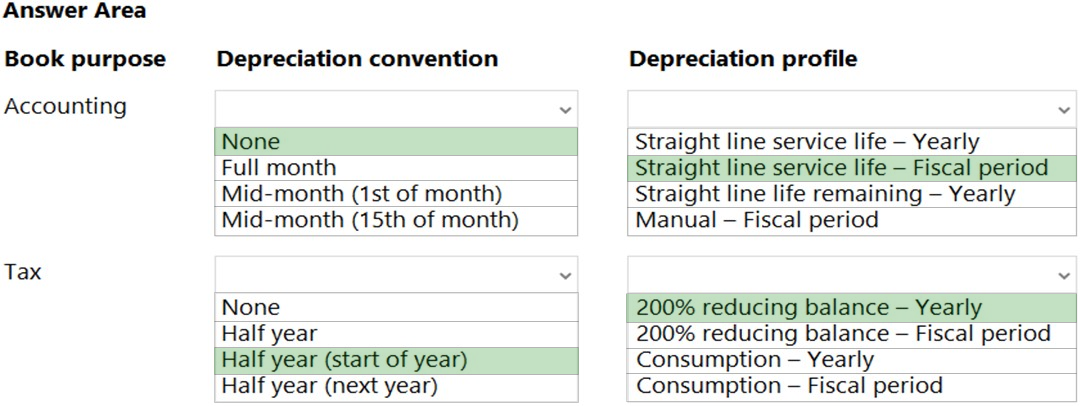

You need to configure a fixed asset group book setup to meet the requirements.

Which depreciation conventions and depreciation profiles should you use? To answer, select the appropriate options in the answer area.

NOTE: Each correct selection is worth one point.

Hot Area:

AliK1i

Highly Voted 1 year, 11 months agovbiz

10 months, 3 weeks agoAlice9

1 year, 9 months agopython123

Most Recent 8 months, 4 weeks ago